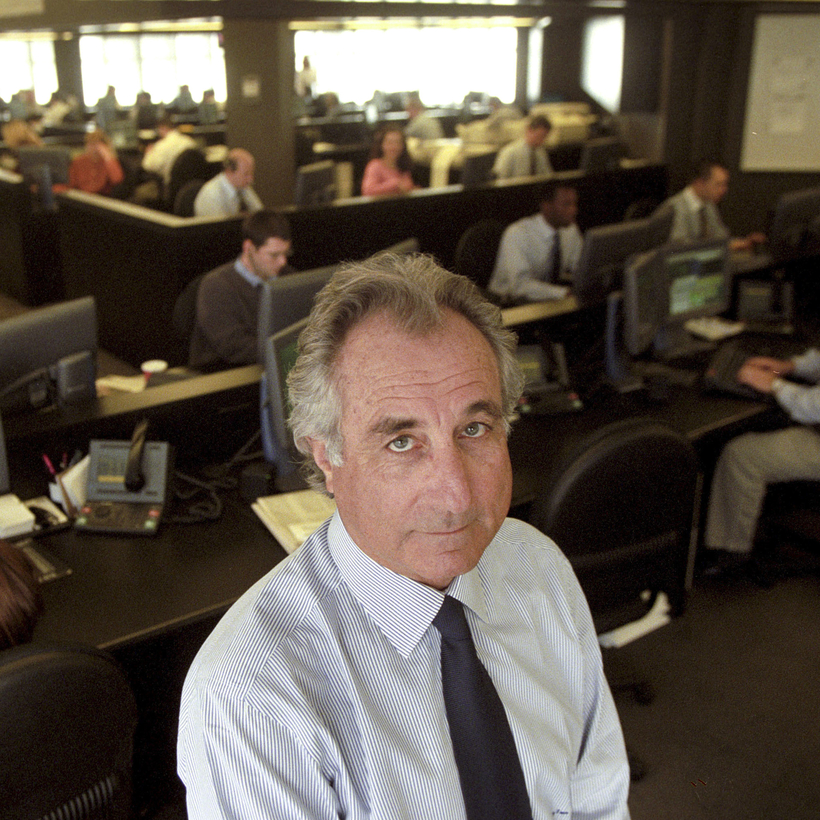

“There is no folly of the beast of the earth which is not infinitely outdone by the madness of man.” So writes Herman Melville in Moby-Dick, and it’s a fitting quote for Richard Behar’s new book, Madoff: The Final Word. Bernie Madoff was, of course, a madman, but he has also become a modern-day white whale for the myriad journalists, prosecutors, bankruptcy experts, victims, enablers, and many others who are still trying to wrestle the thick web of incomprehensible deceit that was Madoff, who died in prison in 2021, into something ordinary human minds can understand.

Behar’s quest to do just that occupied a sizable chunk of his life. At the start of the book, he tells us that he first requested an interview with Madoff in early 2009, just months after the revelation of his $68 billion fraud stunned the world. Behar stayed on the case for 15 years, through more than 300 incoming e-mails and dozens of handwritten letters from Madoff, roughly 50 phone conversations between the two, more than 100,000 pages of documents, and over 300 interviews.